Total Contribution Margin Less Total Fixed Expenses Equal

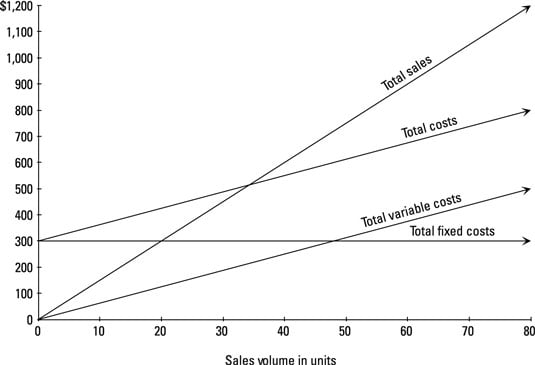

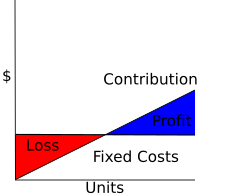

Therefore at breakeven point contribution margin equals total fixed. The contribution margin sometimes used as a ratio is the difference between a companys total sales revenue and variable costs.

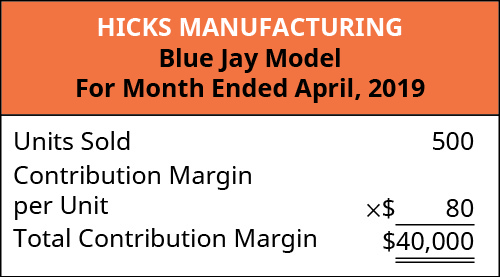

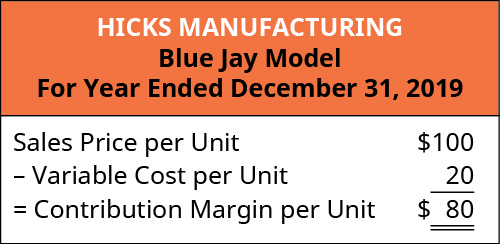

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

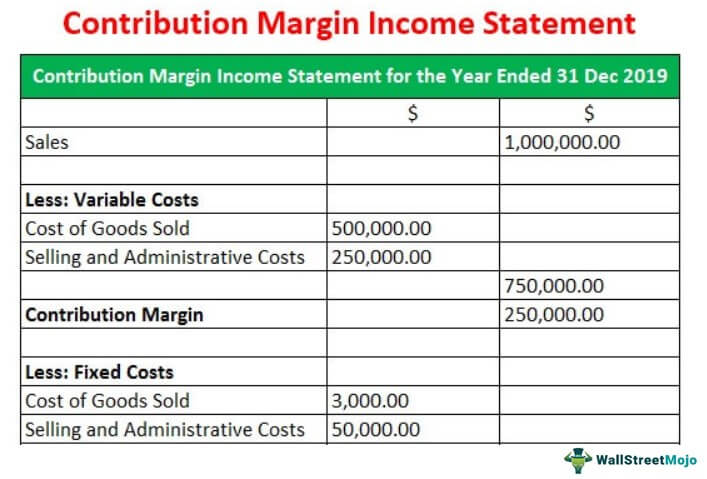

Contribution margin is a cost-accounting calculation that tells a company the profitability of an individual product or the revenue that.

. The total contribution margin is equal to the sales minus the variable costs in a period which could be a month quarter or year. The percentage of fixed costs to variable costsa. Contribution margin is negative.

Fixed costs are greater than sales. If the total contribution margin is less than the total fixed expenses then a _____ 2 words will occur. Equal to total variable costs.

Therefore the total contribution margin would be 30000. Contribution margin is total variable costs minus fixed costs. A net operating loss occurs.

Formula for Contribution Margin. To determine the ratio. If a company is operating at a loss a.

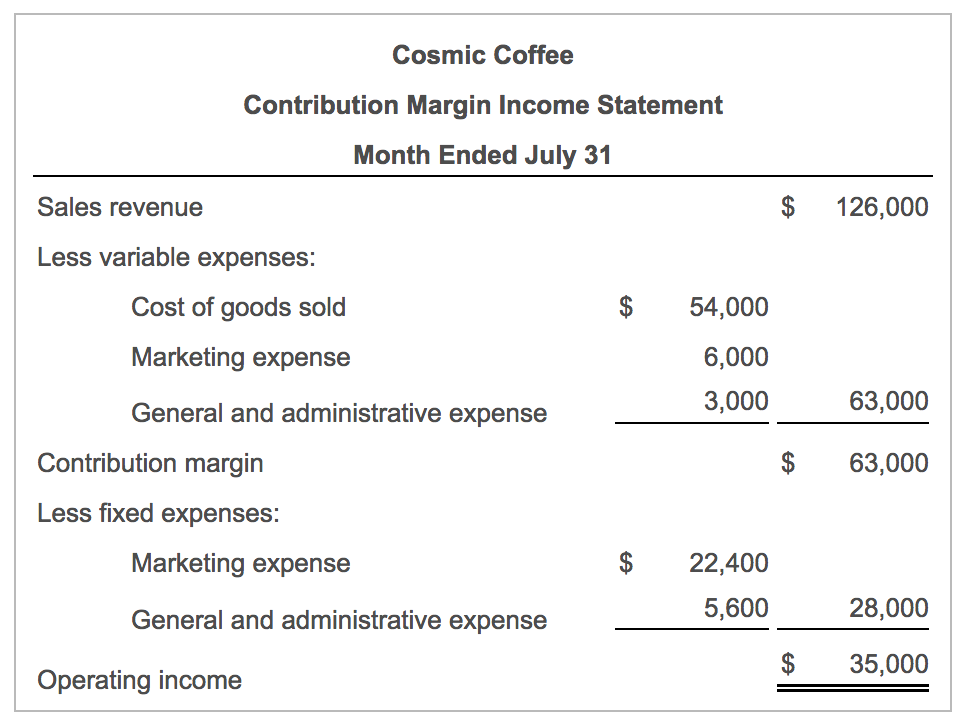

Compute the break-even point in dollars. In other words the contribution margin equals the amount that sales exceed variable costs. Contribution margin per unit Sales price per unit Variable expenses per unit 175 125 50 per unit 100 25.

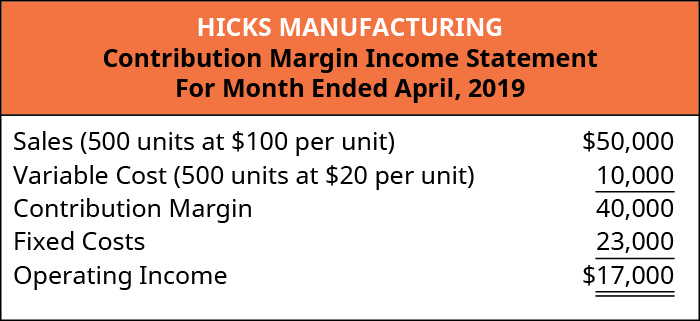

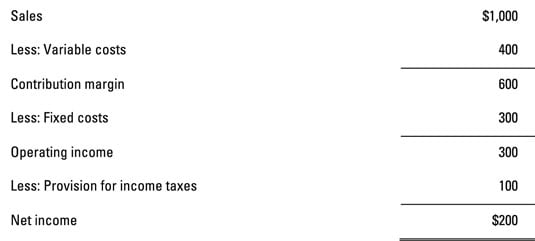

Sales in dollars to meet the target net income would be. The percentage of sales to fixed costs. 20 rows Total contribution margin less total fixed expenses equals operating income.

Using the information provided by Eastern Company calculate per unit and total contribution margin of product-X. Total contribution margin Sales revenue Variable expenses 875000 625000. Hampton Company has total fixed costs of 300000 and a contribution margin ratio of 40.

If the contribution margin is not sufficient to cover fixed expenses. The profit is equal to the contribution margin minus the fixed costs. Fixed costs plus profits C.

Total contribution margin less total fixed expenses equals sales revenue gross profit contribution margin ratio operating income. Total contribution margin is equal to. Contribution is the difference between price and the direct or variable costs of a product or service.

The amount of contribution margin at breakeven point. Density Gauge Thickness Gauge Total Sales Less variable expenses Contribution margin Less direct fixed expenses Segment margin Less common fixed expenses Operating income S150000 80000 S80000 230000 126000 104000 46000 S 70000 20000 S34000 38000 58000 S 50000 S 4000 46000 30000 16000 Includes depreciation. Total profit equals total expenses.

Contribution Margin Net Sales Revenue Variable Costs. The contribution margin equals sales minus all variable costs To calculate the effect on profits of a planned increase in sales you need the increase in units sold any change in fixed costs and the. Foris Companys product sells for 16 and has a variable cost per unit of 12.

Selling price per unit Rs. The answer to the above question is - Operating profit. Contribution margin per unit can be calculated as.

Break-even production in. Variable costs plus profits D. Candice Corporation has decided to introduce a new product.

Equal to total costs. Solved total contribution margin is equal to. 42 Total revenues less total fixed costs equal the contribution margin.

Once the break-even point has been reached the sale of an additional unit of product will lead to an increase in the. Remember the income statement format. View the full answer.

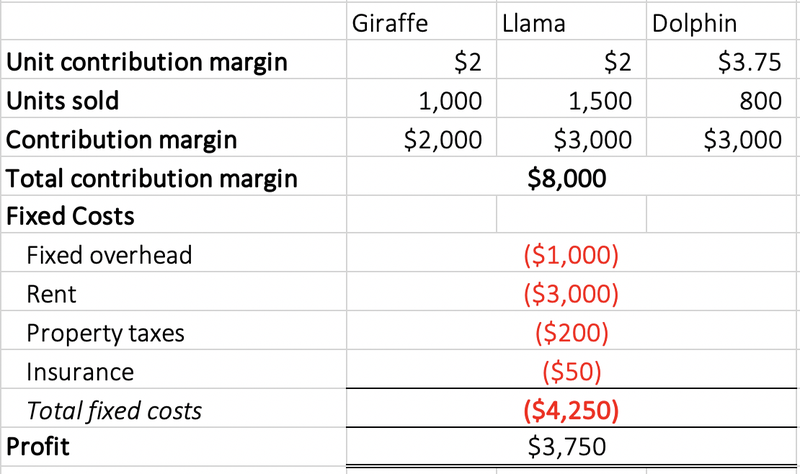

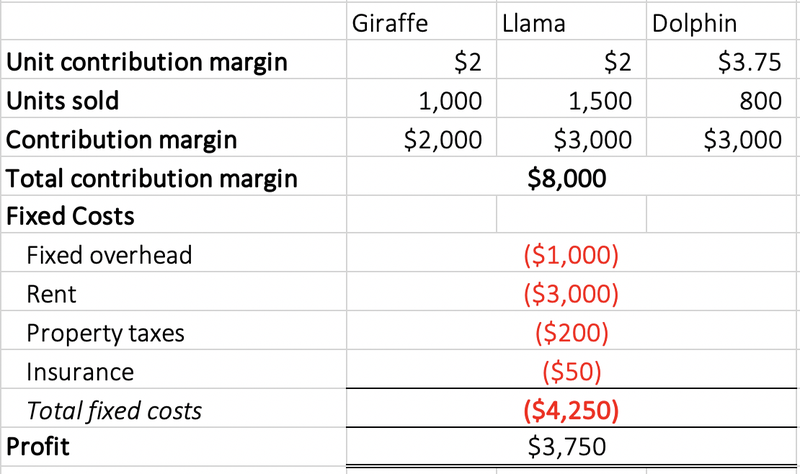

This is the best answer based on feedback and ratings. For a multi-product firm total contribution can be calculated by the formula. Hampton s target net income is 240000.

A product is worth making and selling if it makes a contribution to fixed costs. At the break-even point total contribution margin is a. Sales P2000 Less variable expenses 1400 Contribution margin 600 Less fixed expenses 360 Net income P 240 The company has no beginning or ending inventories.

Variable expenses equal contribution margin. Accounting questions and answers. Contribution margin is equal to total sales minus total variable costs.

The percentage of fixed costs to variable costs. It is the income before fixed costs hence can also be computed as operating income plus add back total fixed costs. Contribution Margin Fixed Costs Net Income.

In terms of computing the amount. A At the break-even the total contribution margin equals total fixed expenses. The percentage that income will increase as sales increase.

Since fixed costs have been paid already any contribution is better than nothing. Fixed costs are 120000. Total sales less profits.

At breakeven point there is no profit or loss meaning total sales equal total costs. The product can be manufactured using either a. Contribution margin divided by number of units sold or selling price per unit minus variable cost per unit.

If fixed costs decrease while the variable cost per unit remains constant the new contribution margin in relation to the old contribution margin will be _____. Total sales less fixed costs B. Hampton s target net income is 240000.

This is the sales amount that can be used to or contributed to pay off fixed costs. Sales VC CM FC profit. A total of 40000 units were produced and sold last month.

The break-even point is reached wen the contribution margin is equal to _____ 3 words equal to. The weighted-average contribution margin percentage changes with changes in sales mix. Variable costs consist of direct labor and.

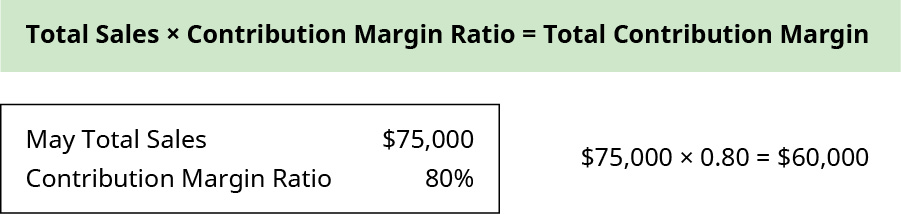

Contribution Margin Ratio Net Sales Revenue -Variable Costs Sales Revenue Sample Calculation of Contribution Margin. 2000000 10000002000000 50 or 50 percent Sales -- 2000000 Variable costs 200000050 -- 1000000 Contribution margin -- 2000000 50 - 1000000 Fixed costs --. The contribution margin ratio is.

The following is the Lux Corporations contribution format income statement for last month. Total revenues less total variable costs equal the contribution margin. Alternatively profit is contribution margin less fixed costs and expenses.

Equal to total fixed costs.

Break Even Point Bep Formula And Calculation Analysis

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

How To Calculate The Unit Contribution Margin The Blueprint

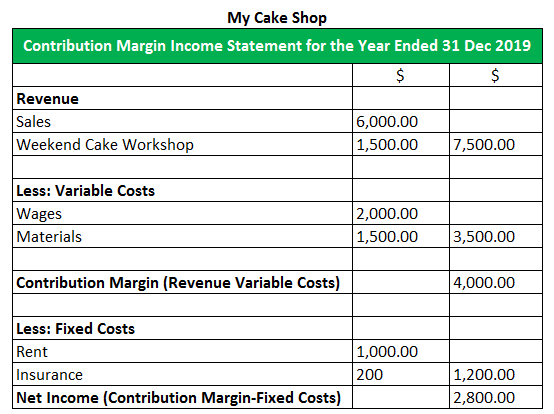

Contribution Margin Income Statement Explanation Examples Format

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

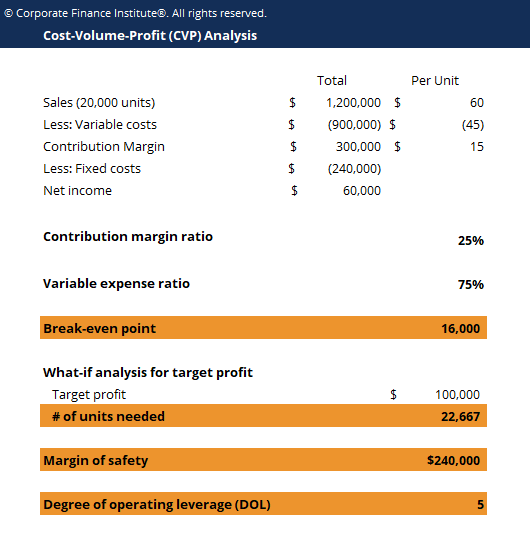

Calculate And Interpret A Company S Margin Of Safety And Operating Leverage Principles Of Accounting Volume 2 Managerial Accounting

Cvp Analysis Guide How To Perform Cost Volume Profit Analysis

Break Even And Target Income Principlesofaccounting Com

How To Compute Contribution Margin Dummies

Keep Or Drop Discontinuing Products Departments And Locations Accounting In Focus

Contribution Margin Ratio Revenue After Variable Costs

Break Even Point Quiz And Test Accountingcoach

How To Prepare A Cost Volume Profit Analysis Dummies

Contribution Margin Income Statement Explanation Examples Format

Comments

Post a Comment